SINGAPORE, 30 September 2022

To manage the surging housing demand and encourage responsible borrowing during the era of higher interest rates, the Singaporean government has unveiled additional cooling measures. The set of measures revealed on September 29, 2022, involves constraints that will limit the loan amounts, affecting both the private and public residential sectors. Moreover, a 15-month waiting time will be enforced for individuals who own or have previously owned a private residence to buy a non-subsidised HDB resale apartment.

In the midst of a rising interest rate climate, the Singaporean authorities have introduced further cooling measures to control the housing demand and to ensure that home purchasers exercise prudence when borrowing. The measures, unveiled on September 29, 2022, feature limitations designed to curb the loan quantum, affecting the private residential and public housing sectors equally. Additionally, a wait-out duration of 15 months will be implemented for private home owners and former private home owners to acquire a non-subsidised HDB resale apartment. (Refer to announcement here).

The announcement of new measures was not entirely unexpected, and we view it as a timely and proactive step to encourage property buyers to exercise more responsible borrowing practices, particularly in light of the projected increase in interest rates. The gradual rise of the medium-term interest rate from 3.5% p.a. to 4% p.a. is a moderate move, considering the rapid ascent of interest rates in recent months (the 3-Month Compounded SORA has surged by over 1% during this period). However, we anticipate that this could lead to some impulsive reactions from prospective private home buyers in the upcoming months, as they reassess their financial calculations and explore alternative options.

Moreover, the 0.5% increment in the medium-term interest rate could potentially have a more pronounced effect on the sales of new executive condominiums (EC), as EC purchasers are subject to a stricter mortgage servicing ratio (MSR) of 30%, compared to the 55% threshold applicable to private home buyers under the Total Debt Servicing Ratio (TDSR).

For instance, consider a scenario where a buyer has a monthly household income of $16,000 and intends to take a loan for a property purchase with a loan tenure of 25 years, LTV of 75%, and no debt obligations. With the new medium-term interest rate of 4%, the maximum loan amount that the buyer can secure will be around $1.667 million. This is in contrast to the previous loan amount of about $1.758 million, resulting in a shortfall of almost $91,000 in loan quantum as shown in Table 1.

The Medium-Term Interest Rate Floor used to compute Total Debt Servicing Ratio (TDSR) has been increased. – Executive Condominium(EC)

In the case of Executive Condo (EC) buyers, the new measures will also have an impact on their borrowing limits, as they are subjected to a stricter Mortgage Servicing Ratio (MSR) of 30%. For example, a buyer with a monthly household income of $16,000 will now only be able to borrow about $909,300 under the revised medium-term interest rate of 4%. This is a decrease of nearly $50,000 from the previous loan amount of $958,800, as shown in Table 2.

Furthermore, in terms of overall property price quantum, the new measures mean that the EC buyer can now only purchase a unit that is priced at $1.212 million, compared to $1.278 million under the previous 3.5% medium-term interest rate. Therefore, it is important for EC buyers to consider their financial capabilities and make informed decisions when it comes to property purchases, taking into account the impact of the new measures on their borrowing limits and overall affordability.

The government has introduced new cooling measures to control the demand for HDB resale flats and moderate the increase in their prices. One of these measures is the introduction of an interest rate floor of 3% for calculating the eligible loan amount for HDB loans. This means that the amount of loan that can be obtained will be based on a higher interest rate, making it harder to borrow more money.

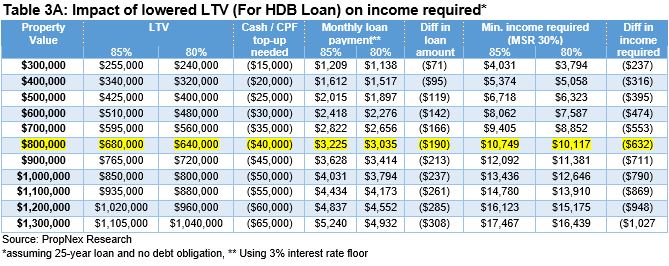

The Loan-to-Value (LTV) limit for housing loans has also been tightened from 85% to 80%. This means that home buyers will need to pay a larger upfront payment for their property purchase, as the amount of loan they can obtain is now lower than before.

Additionally, private home owners and ex-private home owners will have to wait for a period of 15 months after selling their private properties before they can purchase a non-subsidised HDB resale flat. However, this wait-out period will not apply to seniors aged 55 and above (and their spouses) who are moving from their private property to a 4-room or smaller resale flat. It is important for potential home buyers to be aware of these measures and consider them when planning their property purchases

HDB Makes it Harder to Borrow Money for Home Buying with New Rules on Loan Amount and Interest Rates

The HDB has also introduced an interest rate floor of 3% for calculating the eligible loan amount. This means that borrowers will have to pay more interest on their loans, making it harder to borrow more money.

The new measures will also affect buyers who are taking HDB loans to buy their flats. They will be able to borrow less money from HDB, which means they will have to come up with more money themselves. For example, if someone wants to buy an $800,000 flat, they will only be able to borrow $640,000, which is $40,000 less than before. This means they will need to have more money saved up or find other ways to pay for the flat.

But there is a silver lining. With the tighter LTV limit, the monthly loan repayment that buyers have to pay will be lower. For instance, with the new 3% interest rate floor, the monthly loan repayment for an $800,000 flat will be $3,035, which is $50 less than the previous $3,085 computed based on a 2.6% interest rate (see Table 3B).

These measures are designed to control the demand for HDB resale flats and keep their prices from rising too quickly. If you’re planning to buy a home, it’s important to be aware of these new rules and factor them into your calculations when considering your options.

The new measures recently introduced by the government will affect both

those upgrading and downgrading their homes. Buyers looking to upgrade

to a private property will need to recalculate their finances to make up

for the shortfall in loan quantum due to the 0.5% increase in stress

test interest rate. This may involve drawing more on their CPF account

or considering smaller and less centrally-located homes.

Meanwhile,

those downgrading from private property to an HDB flat may have to put

their plans on hold or rent in the meantime. However, those who are

facing financial hardship and need to downgrade may appeal to the HDB.

Stay updated on the latest market updates by subscribing to our

newsletter or reaching out to us directly. As market sentiment turns

cautious amidst interest rate hikes and an uncertain global outlook, we

expect developers to keep prices stable and residential en bloc interest

to wane.