27th April 2023 – Foreign property investors hit with doubled ABSD rates while marginal increases for Singaporean and PR in Singapore’s latest cooling measures

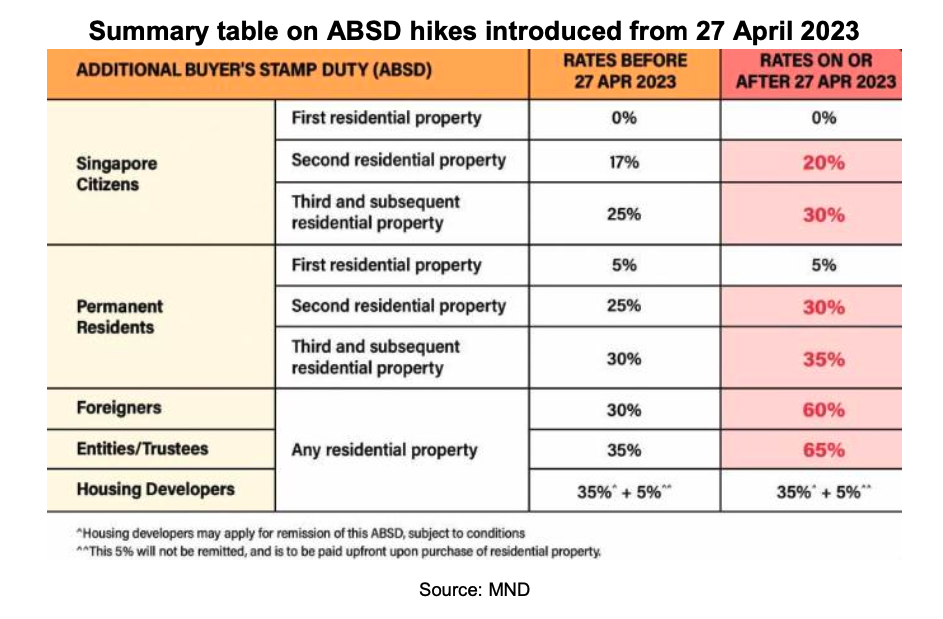

- The Government has announced plans to raise ABSD from April 27

- Effective immediately, foreign buyers will need to pay 60% ABSD when purchasing any residential property in Singapore

- Second-time Singaporean homebuyers will now have to pay a 20% ABSD fee

- The residential property market has seen a strong demand from resident buyers, as well as renewed interest from foreign and local investors

- There is a concern of a continuous increase in property prices compared to income levels if left unaddressed.

27 April 2023, SINGAPORE – In response to a robust housing demand and escalating private home prices, the Singaporean government has taken further steps to cool the residential property market. One key measure involves increasing ABSD rates, with a specific focus on discouraging property investment by foreign buyers. This marks the fourth time that ABSD rates have been raised since December 2011, with the most recent increases occurring in December 2021, July 2018, and January 2013.

We believe that the latest property measures are a proactive response to rising private home prices and strong housing demand in Singapore. By raising ABSD rates, the government is taking a targeted approach to cooling investment demand and preventing price bubbles, which will ultimately benefit all buyers in the long run.

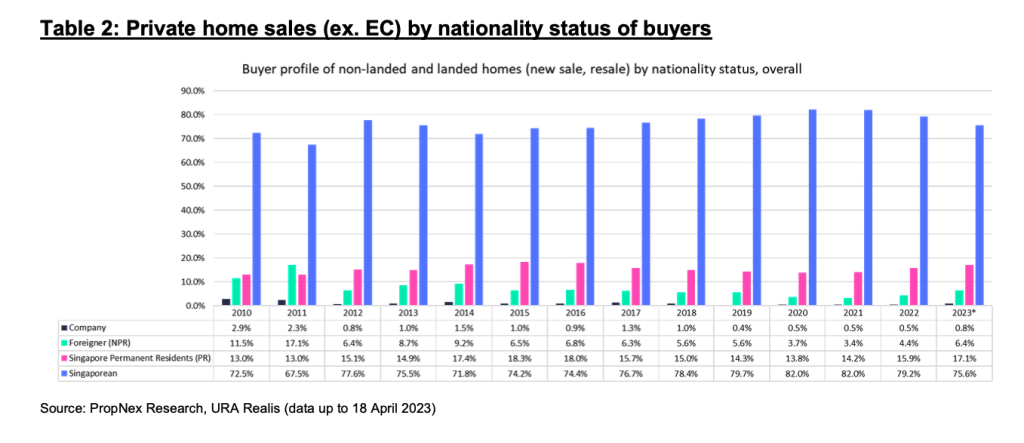

The vast majority of homes in Singapore have been purchased by locals and permanent residents (PRs), with foreigners accounting for only a

small percentage of private home sales. In 2022, foreigners accounted for 11.4% of private homes sold in the Core Central Region, while the

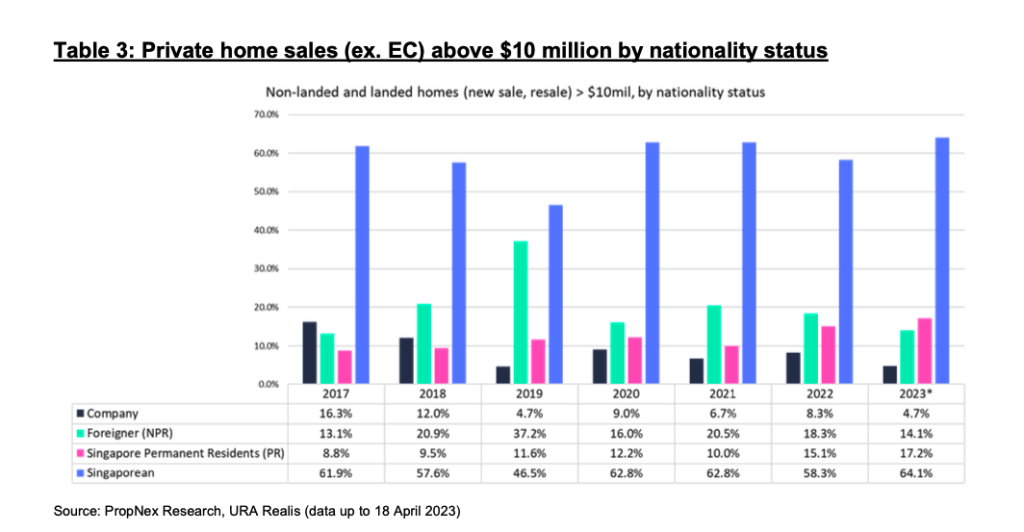

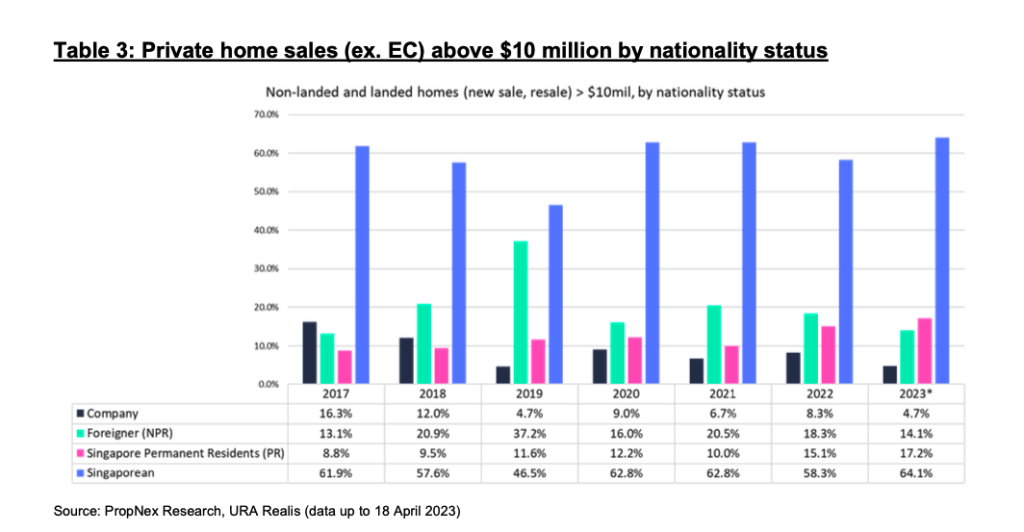

Rest of Central Region and Outside Central Region amounted to 4.2% and 1.5%, respectively. While sales of super luxury homes may see some slowdown due to the doubling of Additional Buyer’s Stamp Duty (ABSD) rates for foreigners,

Singaporeans and PRs still account for a large share of big-ticket home purchases. The ABSD rate for Singaporeans buying a second residential property has been raised from 17% to 20%, and for PRs from 25% to 30%, but the impact

on sales is expected to be measured as many property purchasers today are first-time buyers, including those who have decoupled and are buying

a property separately. In our opinion, housing demand from Singaporeans and PRs is anticipated to remain intact.

In conclusion, our opinion is that to prevent the residential property market from becoming overheated, the Singapore government has introduced further tightening measures that are expected to be supported by the local and PR buyer base. This will lead to developers pricing their units sensibly, while ensuring that private home prices do not increase excessively, allowing HDB upgraders and first-time buyers to enter the market. With foreign buyers accounting for only a small proportion of private home sales, it is anticipated that they may consider investing in other segments such as commercial property and shophouses.