If you’re planning to buy an HDB flat, you need an HFE letter. The HDB Flat Eligibility (HFE) letter is a must-have document. It confirms your eligibility to buy a flat, take an HDB loan, and receive grants. As a real estate agent with over 10 years of experience, I’ve helped many clients understand and apply for the HFE letter. In this article, I’ll explain what the HFE letter is, how to apply for it, and share my honest opinion on the process.

What is the HFE Letter?

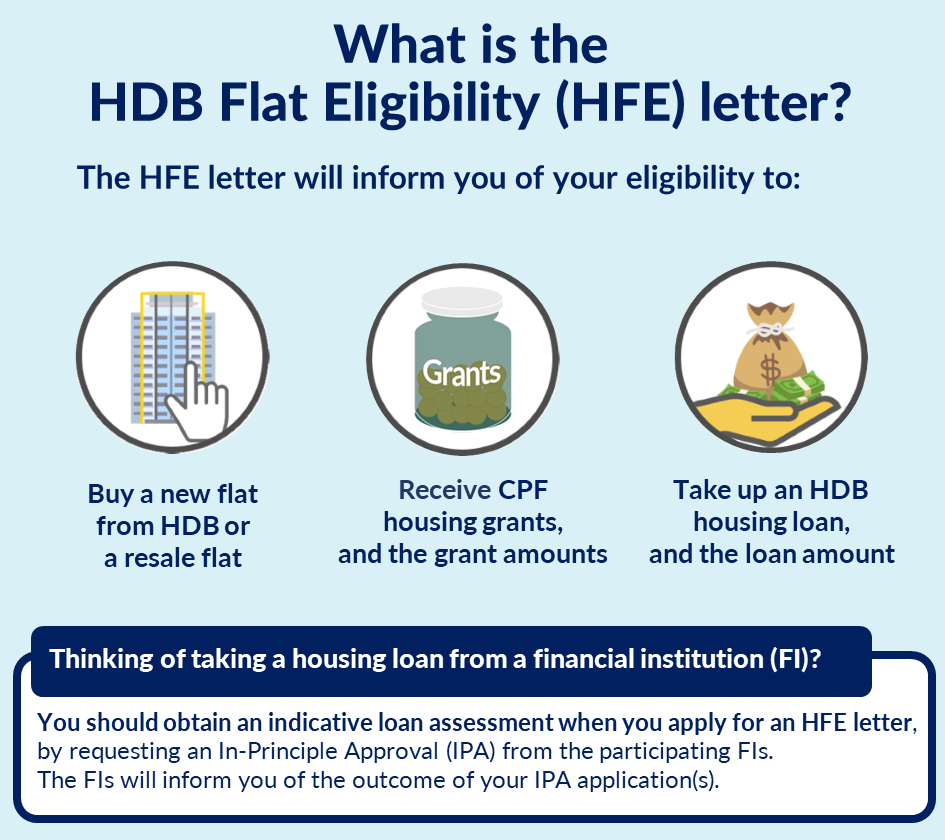

The HFE letter is a document from HDB. It tells you three things:

- Eligibility to Buy a Flat

It confirms if you meet the conditions to buy an HDB flat. These include citizenship, age, and income requirements. - Eligibility for an HDB Loan

If you plan to take an HDB loan, the letter shows if you qualify. It also states the loan amount you can get. - Eligibility for Grants

The letter lists the grants you can receive, such as the Enhanced CPF Housing Grant or Family Grant.

Without an HFE letter, you cannot buy an HDB flat. It’s the first step in your home-buying journey.

How to Apply for the HFE Letter

Applying for the HFE letter is simple. Follow these steps:

- Check Your Eligibility

Use HDB’s online eligibility tools to see if you qualify for a flat, loan, or grants. - Submit Your Application

Log in to the HDB Flat Portal with your SingPass. Fill in the application form with your personal and financial details. - Upload Required Documents

You need documents like your NRIC, income proof, and CPF statements. Make sure they are clear and complete. - Wait for the Result

HDB will review your application. You’ll receive your HFE letter within 21 days.

Why the HFE Letter Matters

The HFE letter is important for several reasons:

- It Saves Time

Knowing your eligibility early helps you plan your budget and flat options. - It Avoids Disappointment

Without the HFE letter, you might find out too late that you don’t qualify for a flat, loan, or grant. - It Simplifies the Process

The HFE letter combines three checks into one document. This makes the home-buying process smoother.

My Honest Opinion as a Real Estate Agent

In my over 10 years as a real estate agent, I’ve seen many clients struggle with the HFE letter. Here’s what I’ve learned:

- Apply Early

Don’t wait until you find your dream flat to apply for the HFE letter. Start the process as soon as you decide to buy a flat. - Prepare Your Documents

Missing or unclear documents can delay your application. Double-check everything before submitting. - Understand Your Eligibility

The HFE letter shows your loan amount and grants. Use this information to plan your budget. - Seek Professional Help

If you’re unsure about the process, consult a real estate agent. They can guide you and answer your questions.

Common Mistakes to Avoid

Many homebuyers make these mistakes when applying for the HFE letter:

- Submitting Incomplete Documents

Missing documents can delay your application. Make sure you have everything ready before applying. - Not Checking Eligibility First

Use HDB’s online tools to check your eligibility before applying. This saves time and avoids disappointment. - Waiting Too Long to Apply

The HFE letter is valid for 6 months. Apply early to give yourself enough time to find a flat. - Ignoring the Results

Read your HFE letter carefully. Understand your loan amount, grants, and flat options before making decisions.

How ZaiDean Can Help

At ZaiDean, we help homebuyers navigate the HDB process. Our team has the experience to guide you through every step, from applying for the HFE letter to finding your dream flat.

If you’re unsure about the HFE letter or need help with your home-buying journey, contact us. We’ll provide personalized advice to make the process easy and stress-free.

Your Next Step

Buying an HDB flat is a big decision. The HFE letter is your first step. Don’t let the process overwhelm you. Contact ZaiDean today for a free consultation. Let us help you start your home-buying journey with confidence.

Click here to schedule your consultation or learn more about our services. Your dream home is within reach!