by ZaiDean | Sep 25, 2024 | Blog

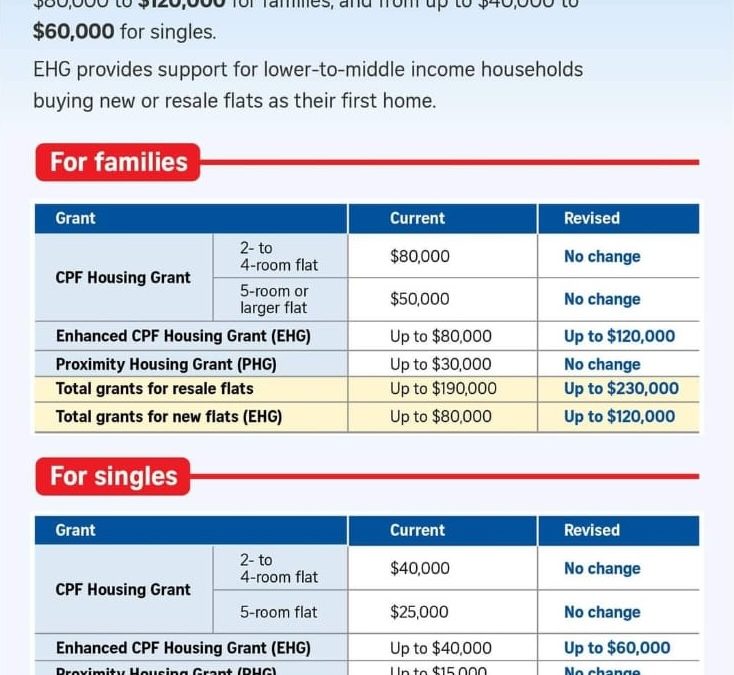

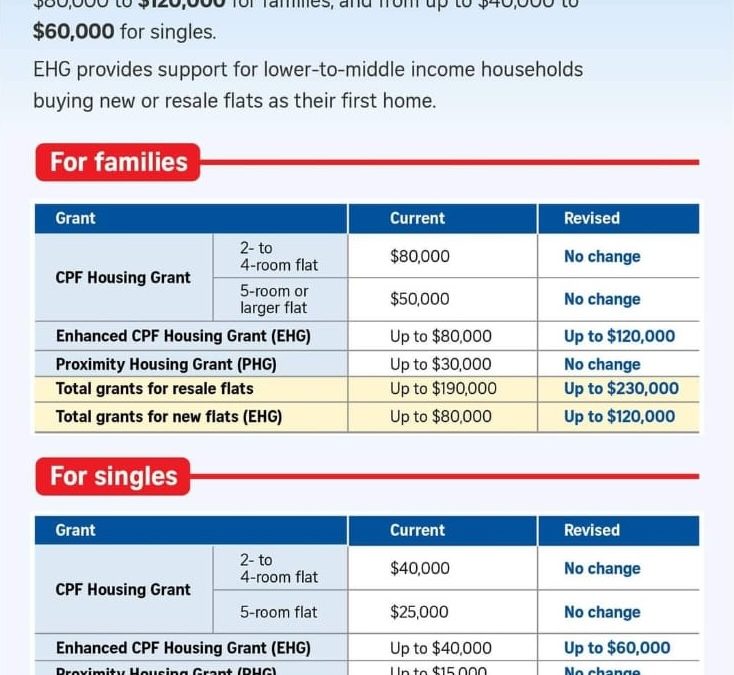

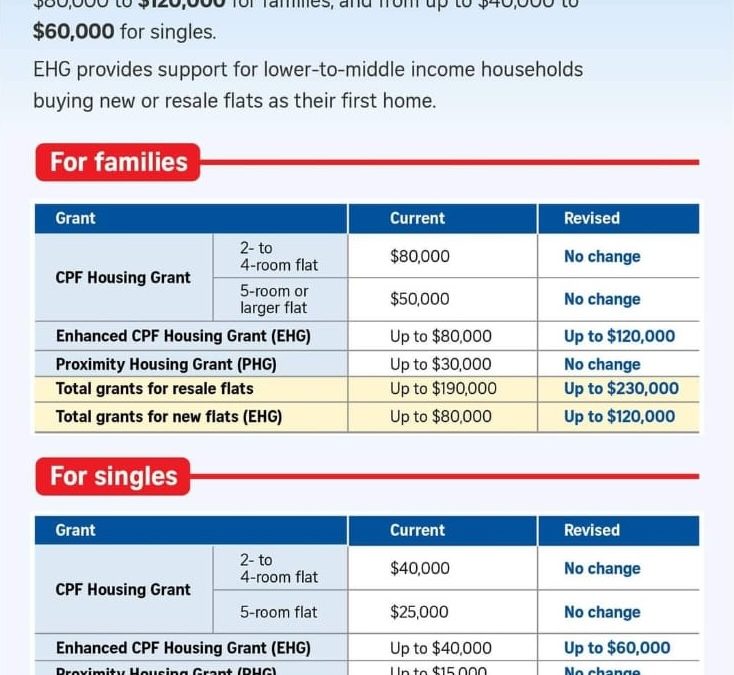

The Enhanced CPF Housing Grant (EHG) provides financial support for lower- to middle-income households purchasing new or resale flats as their first home. Recently, the grant amounts have been revised to offer greater assistance: 1. For Families: EHG increased from up...

by ZaiDean | Sep 18, 2024 | Blog

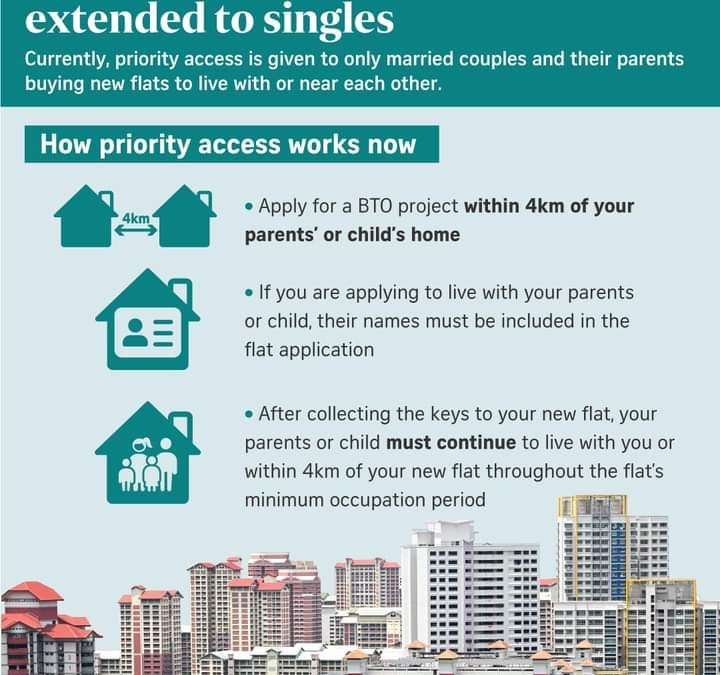

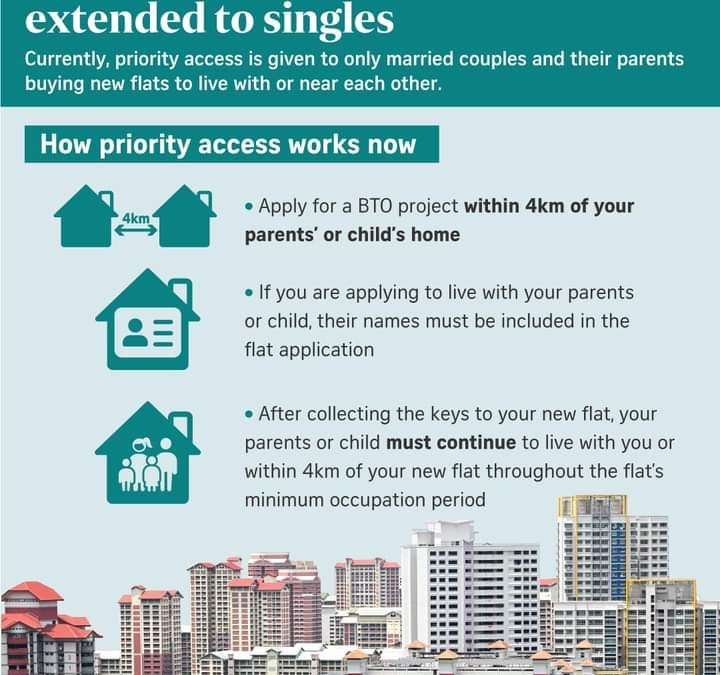

In a significant move to promote intergenerational living and strengthen family bonds, the Housing & Development Board (HDB) of Singapore has expanded its priority schemes to include singles. This initiative, set to roll out progressively from mid-2025, aims to...

by ZaiDean | Sep 11, 2024 | Blog

How to Become a Successful Real Estate Agent in SingaporeAre you considering a career as a real estate agent in Singapore? This guide will walk you through the key steps to launch your career in this dynamic field. From understanding the educational requirements to...

by ZaiDean | Sep 4, 2024 | Blog

Studio Apartment Singapore: Everything You Need to KnowA compact apartment that minimises housework while offering everything you need for comfortable living – what’s not to love about a studio apartment in Singapore?Renting a private room might feel too cramped for...